Request your quote for Florida Homeowners Insurance:

Or if you have all of your information ready:

Harris Insurance has been protecting Florida homeowners since 1965. For over 55 years, we’ve weathered the storms and we know how to protect you against the perils of living in paradise. As the premier source and largest broker of Home Insurance in the Florida Panhandle, no one can beat our rates or experience. We pride ourselves in being the home insurance experts.

Home insurance in Florida has changed a lot over the years: vital coverages are now optional, have been limited, or are eliminated altogether depending upon the company. Because of these changes, it is crucial to do business with experienced agents and a company you can trust.

As an independent broker actively working with more than 150 different insurance companies, Harris Insurance knows all the nuances of the available markets and who to choose depending on location and the coverage’s you need.

A good first step, in researching for homeowners insurance and collecting quotes, is to determine whether or not you should invest in a wind mitigation inspection. You should ask your agent about this and other available discounts!

*Please note that flood protection is not included in your homeowner policy.

Looking to purchase a new home? Download our FREE Guide that explains the Top 5 Things that every Florida home buyer needs to know!

As the trusted choice for Florida’s Homeowner Insurance, we offer policies to protect every unique Florida property & homeowner:

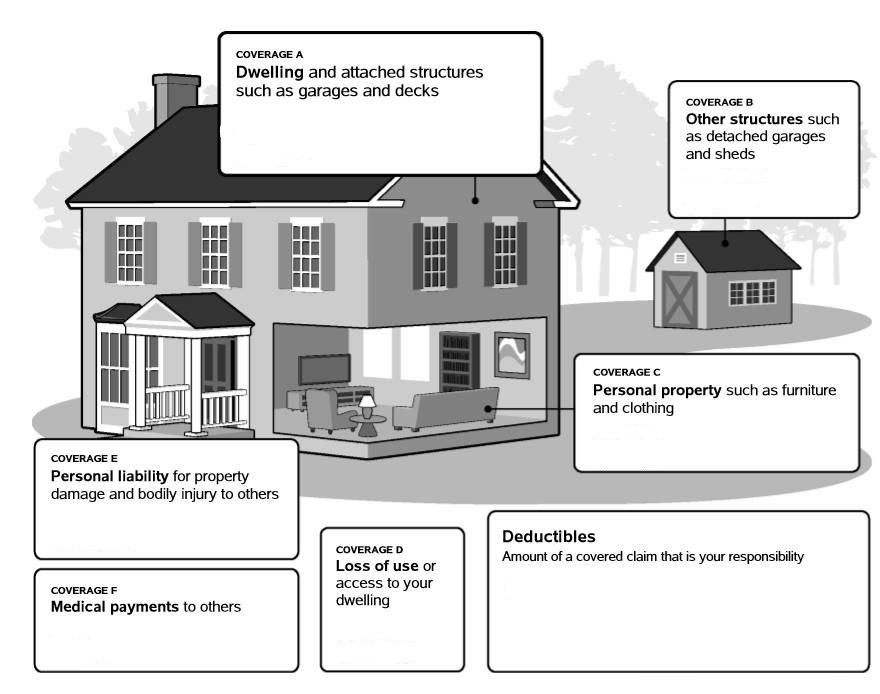

Personal Property Coverages may include:

Ordinance and Law

O&L is included but you may wish to increase coverage for a nominal charge. Laws and codes continually change for rebuilding after catastrophes.

Available at 25% to 50% of home original value

Water Back-up

Water and sewage rising up through toilets and drains can cause significant expense . (1 inch water damage can equal $25,000 worth of damage)!

$25,000 coverage runs around $25.

Water Damage

After storms, water damage is the cause of more claims than any other. The smallest leak or failure can flood your home in minutes. Be sure you have adequate coverage and most importantly, know the protection you have. Not all policies respond the same.

Screened Enclosures

Are you properly protected? Most insurance companies have changed how they address coverage specific to screened enclosures. If you have a large enclosure, be sure you understand how your policy will respond.

Service Line

Protects you from unexpected expenses for water, sewer, electric and other service lines that run above or underground to your residence. When there’s a problem with these lines it’s very expensive and disruptive not only to the service but also to your landscape. $10,000 usually runs around $40 annually.

Personal Injury

In the internet age of posting messages online, personal injury is a must. Even the allegation of libel or slander can cost you thousands. This protection runs as little as $15/year.

Refrigerated Personal Property

Most usually have several hundred dollars’ worth of goods in their refrigerator and freezer at any given time. You can insure the value of this investment for as little as $10-15/year.

Animal Liability

NOT just for dog bites! What if your pet gets out and causes an auto accident? Anything that happens involving your pet can have ramifications. Be sure to protect yourself by adding the valuable coverage.

$25,000-$50,000 coverage is only around $50.

Jewelry, Guns, Fine Art Collections

High value items are the target of theft. You can protect your valuables by adding this special coverage or adding a secondary policy that can protect even against mysterious disappearance. A current appraisal is all we need to get you protected.

Identity Theft

CNBC reports seniors lose at least $37 Billion every year to fraud. Get an ID theft resolution option for a surprisingly low annual cost.

Golf Cart Liability

If you own a golf cart, you need this coverage extension to protect against any bodily injury or property damage.

Equipment Breakdown

Protect your important home systems from breakdown or mechanical failure. HVAC units, appliances, TVs, even garage door openers are covered! $50,000 is usually around $50.

Hurricane Deductible

Flood

NOT in a flood zone? Neither are the majority of homes in America that experience flooding. The statistics are even higher in Florida.

Please consider a flood policy and let your agent share your options.

Other Options & Potential Discounts for Homeowner Insurance:

Claim-Free Discounts

Companion/Additional Policy Discounts

Fire/Burglar Alarm Credits

Gated and/or Guarded Community Credits

Inflation Guard

Insurance Score Credits

Loyalty Discounts

Military Discounts

Mortgage Protection Discounts

Non-smoker Discounts

Pay-in-full Discounts

Proof of Updates to Electric, HVAC, Plumbing, Roof Systems

Senior Discounts

Wind Shutter Credits

Wind Deductible Buyback

Wind Mitigation Inspection Credits

Harris Insurance is a licensed insurance brokerage firm authorized to serve throughout the State of Florida. We are a full-service insurance provider since 1965. We represent more than 150 insurance companies in order to bring the most reputable, "A" rated, insurance companies under one roof to provide comprehensive solutions for your insurance needs.

We can provide all kind of insurance policies including Homeowners Insurance from a variety of companies with multiple rates. Our agents work hard to bring you the most competitive & comparative rates in the industry. We will work with you one-on-one to ensure your complete satisfaction.

Harris Insurance is a licensed insurance brokerage firm authorized to serve throughout the State of Florida. We are a full-service insurance provider since 1965. We represent more than 150 insurance companies in order to bring the most reputable, "A" rated, insurance companies under one roof to provide comprehensive solutions for your insurance needs.

We can provide all kind of insurance policies including Homeowners Insurance from a variety of companies with multiple rates. Our agents work hard to bring you the most competitive & comparative rates in the industry. We will work with you one-on-one to ensure your complete satisfaction.